WHAT

Smart machinery financing

The collaboration between Findustrial and Lendscape enables companies to integrate usage-based pay-per-use financing models into their business processes. Manufacturers and financial service providers can flexibly access this innovative solution, benefiting from a data-driven, high-performance platform.

HOW

Plug and play for asset financiers

Together, Findustrial and Lendscape have developed a plug-and-play tool that allows asset financiers to implement pay-per-use models quickly and easily. Through a standardized interface, IoT data can be integrated to automate billing based on actual usage.

WHY

Win-win for customers and companies

The growing demand for flexible financing calls for solutions like pay-per-use. The partnership between Findustrial and Lendscape provides this flexibility, reduces investment costs, and improves cash flow management, while enabling financiers to unlock new business opportunities.

What is a pay-per-use model?

= Asset users repay the financing of the asset on the basis of actual use

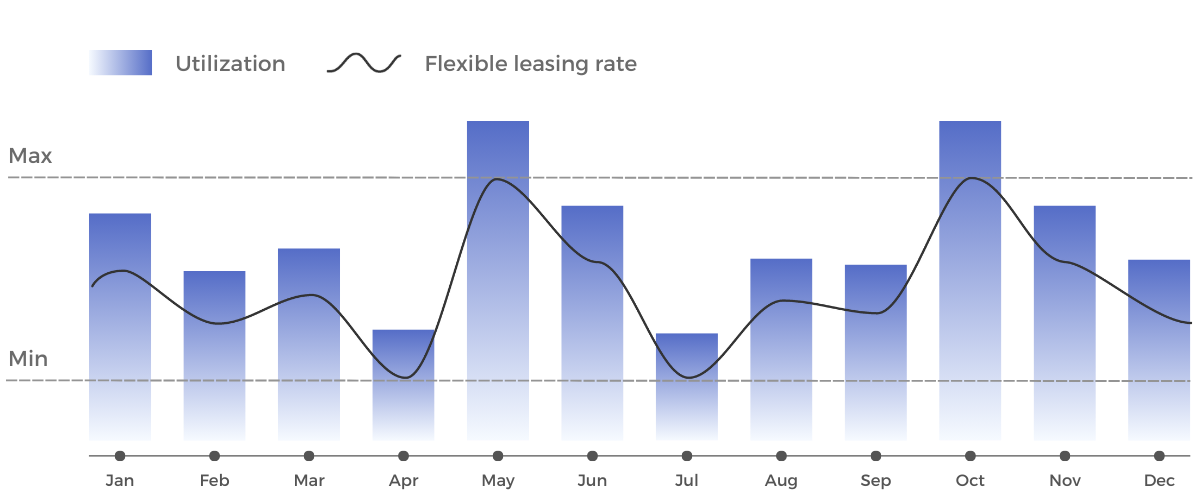

The leasing rates are calculated automatically on the basis of actual use. If utilization is low, the leasing rate automatically decreases down to a minimum. If utilization increases, the leasing rate rises up to a defined maximum.

Pay-per-use sales financing models allow asset manufacturers to quickly enter usage-based business models without sacrificing cash flow.

Investment decisions are simplified for customers, as flexible repayments in pay-per-use models help secure liquidity. Additionally, with high utilization, the term can be shortened, allowing for interest savings.

Pay-per-use leasing calculation

Price per hour

20,- €

Smart financing – executed with experts

Contact us today to learn more and create a tailored solution for your business.

We look forward to supporting you on your pay-per-use or as-a-service journey!